3,601 total views

SARFAESI Act, 2002 was formulated to promote the establishment of Asset Reconstruction Companies (ARCs) and Asset Securitization Companies (ASCs) to deal with rising NPAs that the banking and financial institutions deal with. The Act provides three important tools or methods into asset management of banking and FIs for recovery of NPAs:

- Securitization of financial assets by banks and financial institutions

- Reconstruction of financial assets by banks and financial institutions

- Enforcement of security interest by banks and financial institutions

Tool No. 1: Securitisation

Securitisation is the procedure of issuing marketable securities supported by a pool of existing assets like home or auto loans. The loan ought to be a secured loan. After an asset is transformed into a marketable security, it is sold. A reconstruction company or securitisation company may raise funds from only the Qualified Institutional Buyers (QIB) by creating schemes for acquiring assets that are financial.

As per section 2 (1) (z) of the SARFAESI Act, 2002, “securitisation” means:

“acquisition of financial assets by any securitisation company or reconstruction company from any originator, whether by raising of funds by such securitisation company or reconstruction company from qualified institutional buyers by issue of security receipts representing undivided interest in such financial assets or otherwise”

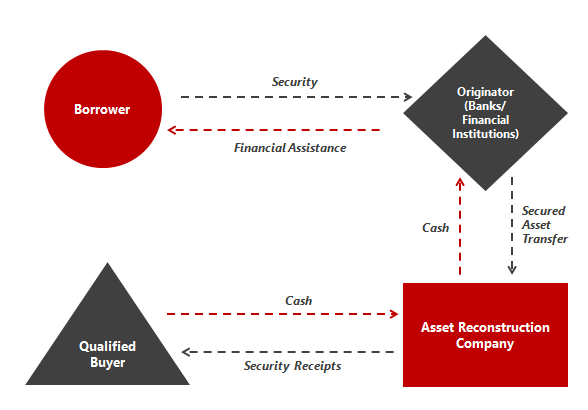

The following figure exhibits the process of securitisation:

Tool No. 2: Asset Reconstruction

Enacting SARFAESI Act has given birth to the Asset Reconstruction Companies in India. It can be done by either proper management of the business of the borrower, or by taking over it or by selling a part or whole of the business or by the rescheduling of payment of debts payable by the borrower enforcement of security interest in accordance with the provisions of this Act.

Tool No. 3: Enforcement of Security Interest

Section 13 of the SARFAESI Act, is the key provision in the Act providing for enforcement of security interest. This section acts as the most effective tool provided to the secured creditors which are the financial institutions, as it permits the secured creditors to enforce security interest without the intervention of any court or tribunal. However, before enforcing the security under Section 13(4) of the Act, the secured creditor can first proceed against the guarantor or sell the pledged assets. Firstly, for enforcing the security, the secured creditor has to issue a 60 days notice to the borrower whose account has been classified as NPA. In case, the borrower has objections to the said notice which is communicated to the FI, the secured creditor ought to consider the objections and reply to the borrower with reasons for not accepting them. However, this communication of reasons does not confer upon the borrower any right to apply to DRT or any other Court. It is pertinent to mention that on receipt of 60 days notice the borrower cannot transfer the secured assets without the consent of the secured creditor. Even after which the borrower fails to make the payment, the FI could resort to any of the following:

- Take ownership of the security;

- Sale or lease or assign the right over the security;

- Employ Manager to manage the security;

- Ask any debtors of the borrower to pay any sum due to the borrower.

Exemption from Registration of Security Receipt

The SARFAESI Act also provides an exception under the registration of security receipt. It means that when an asset reconstruction company or securitization company issues receipts, the holder of those receipts is enabled to undivided interests in the financial assets and thereby creating no necessity of registration unless and otherwise, it is compulsory under the Registration Act, 1908. However, the registration of the security receipt is required in the following cases:

- Where there is a transfer of receipt.

- The security receipt is creating, declaring, assigning, limiting, extinguishing any right title or interest in an immovable property.

IMPORTANT PRECEDENTS

- M/s Shree Anandhakumar Mills v. M/s Indian Overseas Bank & ors. (C.A. No(s). 7214-7216 of 2012)

The Supreme Court held that a suit for partition would not be maintainable in a situation where proceedings under the SARFAESI Act had been initiated. While arriving at its decision, the Apex Court made reference to the case of Jagdish Singh vs. Heeralal. In the case, it was also held that the remedy of any person aggrieved by the initiation of proceedings under the SARFAESI Act lies under section 17 of the SARFAESI Act which provides for an efficacious and adequate remedy to a party aggrieved.

- Suraj Lamp & Industries Private Limited (2) v. State of Haryana & Anr. (2012)1 SCC 656

The Supreme Court held that the plea that the secured creditor retains the right to obtain possession of the immovable property, even after execution and registration of the deed of conveyance in favour of the purchaser is misplaced. The Court further held that the transfer of immovable property by way of a sale can be done by a deed of conveyance duly executed, stamped and registered under the Registration Act, 1860.

- Mardia Chemicals Ltd. Vs Union Of India (AIR 2004 SC 2371)

The constitutionality of the Securitisation Act was upheld except 17(2) of the Act. In this case, the Supreme Court of India stated the SARFAESI Act to be constitutionally valid. The Court opined that a borrower may make an appeal against the lender in the DRT, without having to deposit 75% of the sum of the debt. If the tribunal does not stay the order, the lender may sell the assets. When SARFAESI Act came into force in 2002, ICICI Bank took possession of Mardia Chemical plant in Vatva, Ahmedabad district, Gujarat. ICICI Bank was owed Rs. 300 crores, in all it owed Rs. 1,450 crores to 20 lenders

- Transcore Vs Union Of India (AIR 2007 SC 712)

Withdrawal of suit pending before DRT under DRT Act, 1993 is not a pre-condition for taking recourse to the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 is an additional remedy, which is not inconsistent with DRT Act, 1993 and, therefore, doctrine of election has no application. The court opined that SARFAESI Act is a special enactment which was enacted by the Parliament to provide speedy remedy to the banks and financial institutions without recourse to the court of law. On the other hand, the Arbitration and Conciliation Act, in contrast, is a statute of general nature. Merely because steps are taken under this general law would not mean that remedy under the special statute is foreclosed. If at all, legal position is just the reverse.

- Central Bank of India Vs State of Kerla (JT 2009 (3) SC 216)

A statutory first charge over property under any law will prevail over rights created in favour of secured creditors such as banks and other financial institutions.

- United Bank of India Vs Satyawati Tandon and Others (AIR 2010 SC 3413)

Where statutory remedies are available under a fiscal statute then exercise of jurisdiction under Article 226 by High Court for passing orders, which could have a serious adverse impact on the right of banks and other financial institutions to recover their dues, is not warranted

- State Bank of India Vs Sharda Spuntex (2010) BC 562 Rajasthan

Transactions in derivatives, fall within the category of “business activity undertaken by the Bank” as they are covered by Section 6(1) of the Regulation Act. If the transaction in question gives rise to a claim by the Bank, of any liability, on the part of the Company, the Bank may certainly be able to invoke the provisions of DRT Act. Further held that what is expressly permitted by law, cannot be held to be opposed to public policy

- Durga Durga Hotel Complex Vs. Reserve Bank of India and ors

The Court held that by virtue of Clause 16(3) of the scheme, no complaint would lie before the Ombudsman, once the foundation for such a complaint is lost, on account of the Bank filing an application before the Competent Forum on the same subject matter.

- BOI Finance Ltd. Vs Custodian and Others; AIR 1997 SC 1952

The Hon’ble Supreme Court held that non-compliance of the directions issued by the Reserve Bank of India may result in prosecution/or levy of penalty under Section 46, but it cannot result in invalidation of any contract by the bank with the third party.

- ICICI Bank Ltd. Official Liquidator of APS Star Industries Ltd. (2010) 10 SCC 1:

The Hon’ble Supreme Court held that debt is an asset in the hands of the bank as a secured creditor or mortgagee or hypothecate. Bank can always transfer its asset. Such transfer in no manner affects any right or interest of borrower(s) (customer). The moment bank transfers debt with the underlying security, the borrower(s) ceases to be borrower(s) of assignor Bank and becomes borrower(s) of assignee Bank

- Inderjeet Arya Vs. ICICI Bank Ltd., (2014) 2 SCC 229

The Hon’ble Delhi High Court held that protection is available only against action that comes within the ambit of term suit as used under S. 22(1). Proceedings before DRT, held, do not fall within the ambit of the suit as used under S. 22(1). Action if does not fall within the ambit of term suit, no protection would be available under S. 22(1). Thus, protection under section 22(1), held, not available to Directors and guarantors of a sick company against whom recovery proceedings were filed by Bank before Debts Recovery Tribunal (DRT). Term suit in section 22(1) applies only to proceedings in civil court and not actions or recovery proceedings filed by banks and financial institutions before a tribunal such as DRT

CONCLUSION

The Laws of recovery by Banking and Financial institutions have evolved over a large period of time. Although both Debt Recovery Tribunal and SARFAESI Act has enabled the FIs to recover from their bad debts in turn proving to be beneficial to the institutions, the courts have equally shaped the legislature by adjudicating and setting precedents. The act was formulated to mobilise stagnant funds of the FIs as the non-performing assets. The provisions of the Act was made to balance the issues and requirement between the FIs and the borrowers. It is pertinent to mention that the courts in furtherance to the laws play a vital role in safeguarding the interest of the FIs as well as the borrowers by enable circulation of the public funds.

The enforcement of the SARFAESI Act has a profound impact on the banking system. The act empowers bankers to take possession of the secured asset and to sell the same for the recovery of debt or dues post borrower fails to repay the debt within the stipulated time as agreed by the borrower with the FI. The act enables the FIs to repossess and enforce the secured asset without judicial intervention. This leads to a speedy process to safeguard the interest of the FI in recovering its debt/dues without having to face legal cost on recovery proceedings. In adjudicating recovery proceedings under the SARFAESI Act, there is an exclusion on the jurisdiction of the civil courts however Debt Recovery Tribunals (DRTs) have complete jurisdiction for adjudication of the proceedings for borrowers.

The SARFAESI Act has got more gain for an FI in terms of speedy recovery without incurring hefty legal costs. However, the borrowers/defaulters, SARFAESI Act proves to be ineffective in protecting their interest.

Leave A Comment Cancel reply

Recent Comments

- Why registration of a Private Limited Company is not a good idea? : Knovalt on One Person Company (OPC)

- Why registration of a Private Limited Company is not a good idea? : Knovalt on Registration of a Private Limited Company In India

- Rajat Khaneja on Essentials of a valid letterhead

- Udyog Aadhaar Registration Fees on Micro, Small & Medium Enterprise (“MSME”) Registration

- Sonal on Casual Vacancy in the office of Auditor(s) (Non-Govt company)