-

AuthorRajat Khaneja

-

Comments0 Comments

-

Category

3,104 total views

Introduction

In today’s scenario when many companies are taking over the operations and management of other companies in order to diversify, grow and scale-up, you might have heard the term “Takeover” a lot. However, do you know the exact legal meaning of this term? who regulates the process of takeover? In this article, we shall discuss the meaning, types and legal aspect of a takeover of a company.

A takeover means the purchase of one company by another company. A takeover occurs when one company makes a bid to assume control of or acquire another, often by purchasing a majority stake in the target firm. In the takeover process, the company making the bid is the acquirer while the company it wishes to take control of is called the target.

On 23rd September, 2011, the Securities and Exchange Board of India(SEBI) notified SEBI (Substantial Acquisition of shares and takeovers) regulations, 2011 w.e.f 22nd October, 2011. These regulations contain provisions applicable to takeovers in India. This code is applicable on the takeover of listed companies since the SEBI has to ensure the protection of public shareholders.

Objectives of Takeover code

As per the SEBI Takeover Code, the following are the objectives of this code:

- To provide transparency in bulk acquisition of shares of the target listed company.

- To provide a reasonable profit to the small shareholders of the target company while the management

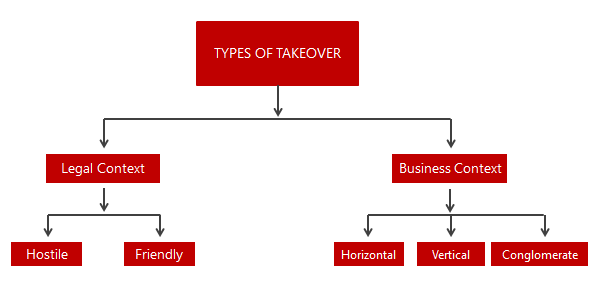

Types of Takeover

There are various types of takeover of a company. The following figure exhibits the types of takeover:

In Legal context, a takeover can be categorised into two types:

- Friendly takeover

- Hostile takeover

Friendly Takeover

A friendly takeover means the takeover of one company by a change in its management & control through negotiations between the existing promoters and prospective investor in a friendly manner. Thus it is also called Negotiated Takeover. This kind of takeover is resorted to further some common objectives of both the parties.

Example: Facebook takeover of WhatsApp is another big example of a friendly takeover where Facebook bought WhatsApp for USD 19 Billion.

Hostile Takeover

A hostile takeover is a takeover where one company unilaterally pursues the acquisition of shares of another company without being into the knowledge of that other company, or if the target company’s board rejects the offer, or the bidder makes the offer directly after having announced its firm intention to make an offer.

The most dominant purpose which has forced most of the companies to resort to this kind of takeover is an increase in the market share.

Example Larsen and Toubro Ltd (L&T) gained a controlling interest in Mindtree Ltd, raising its stake to 60% in the Bengaluru-based company.

In the context of business, a takeover is of three types:

- Horizontal Takeover

- Vertical Takeover

- Conglomerate takeover

Horizontal Takeover

A takeover of one company by another company in the same industry. The main purpose behind this kind of takeover is achieving the economies of scale or increasing the market share.

Example: Takeover of Henkel by Jyothy Laboratories. Jyothy bought 50.97% stake in Henkel India. Since it was done in the same industry, the same could be termed as Horizontal takeover. Also, in a legal context, it could be termed as a Hostile Takeover.

Vertical Takeover

A takeover by one company of its suppliers or customers and vice versa. Vertical acquisition provides an indirect method of increasing market share by controlling competitors’ access to essential supplies.

Example: Takeover of Sona Steerings Ltd. by Maruti Udyog Ltd.

Conglomerate Takeover

A takeover of one company by another company operating in totally different industries. The main purpose of this kind of takeover is diversification.

Example: One example of a conglomerate merger was the merger between the Walt Disney Company and the American Broadcasting Company.

Leave A Comment Cancel reply

Recent Comments

- Why registration of a Private Limited Company is not a good idea? : Knovalt on One Person Company (OPC)

- Why registration of a Private Limited Company is not a good idea? : Knovalt on Registration of a Private Limited Company In India

- Rajat Khaneja on Essentials of a valid letterhead

- Udyog Aadhaar Registration Fees on Micro, Small & Medium Enterprise (“MSME”) Registration

- Sonal on Casual Vacancy in the office of Auditor(s) (Non-Govt company)